When you leave your job or retire, you have an opportunity to manage your funds in an employer-sponsored retirement plan such as a 401(k), 403(b), or government 457(b) plan. Depending on the situation, you generally have four options.* The approach that typically gives you the most control over the funds is to transfer some or all of the assets to an IRA through a rollover.

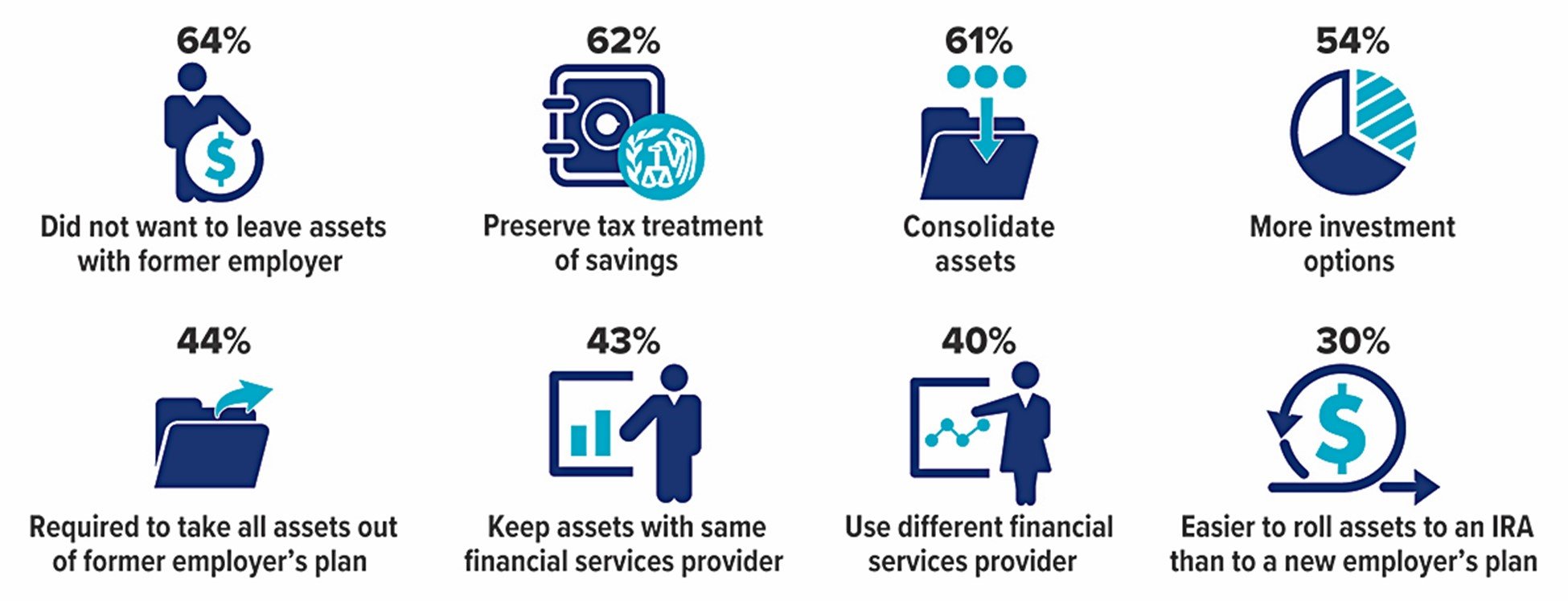

Three out of five households who owned traditional IRAs in 2022 had executed at least one IRA rollover from an employer-sponsored retirement plan. These were the top reasons for the most recent rollover.

*Other options may include leaving assets in the former employer's plan, transferring assets to a new employer-sponsored plan, or withdrawing the money.

Source: Investment Company Institute, 2023 (multiple responses allowed)