The SECURE 2.0 Act, passed in late 2022, included numerous provisions affecting retirement savings plans, including some that impact required minimum distributions (RMDs). Here is a summary of several important changes, as well as a quick primer on how to calculate RMDs.

What Are RMDs?

Retirement savings accounts are a great way to grow your nest egg while deferring taxes. However, Uncle Sam generally won't let you avoid taxes indefinitely. RMDs are amounts that the federal government requires you to withdraw annually from most retirement accounts after you reach a certain age. Currently, RMDs are required from traditional IRAs, SEP and SIMPLE IRAs, and work-based plans such as 401(k), 403(b), and 457(b) accounts.

If you're still working when you reach RMD age, you may be able to delay RMDs from your current employer's plan until after you retire (as long as you don't own more than 5% of the company); however, you must still take RMDs from other applicable accounts.

While you can always withdraw more than the required minimum, if you withdraw less, you'll be subject to a federal penalty.

Four Key Changes

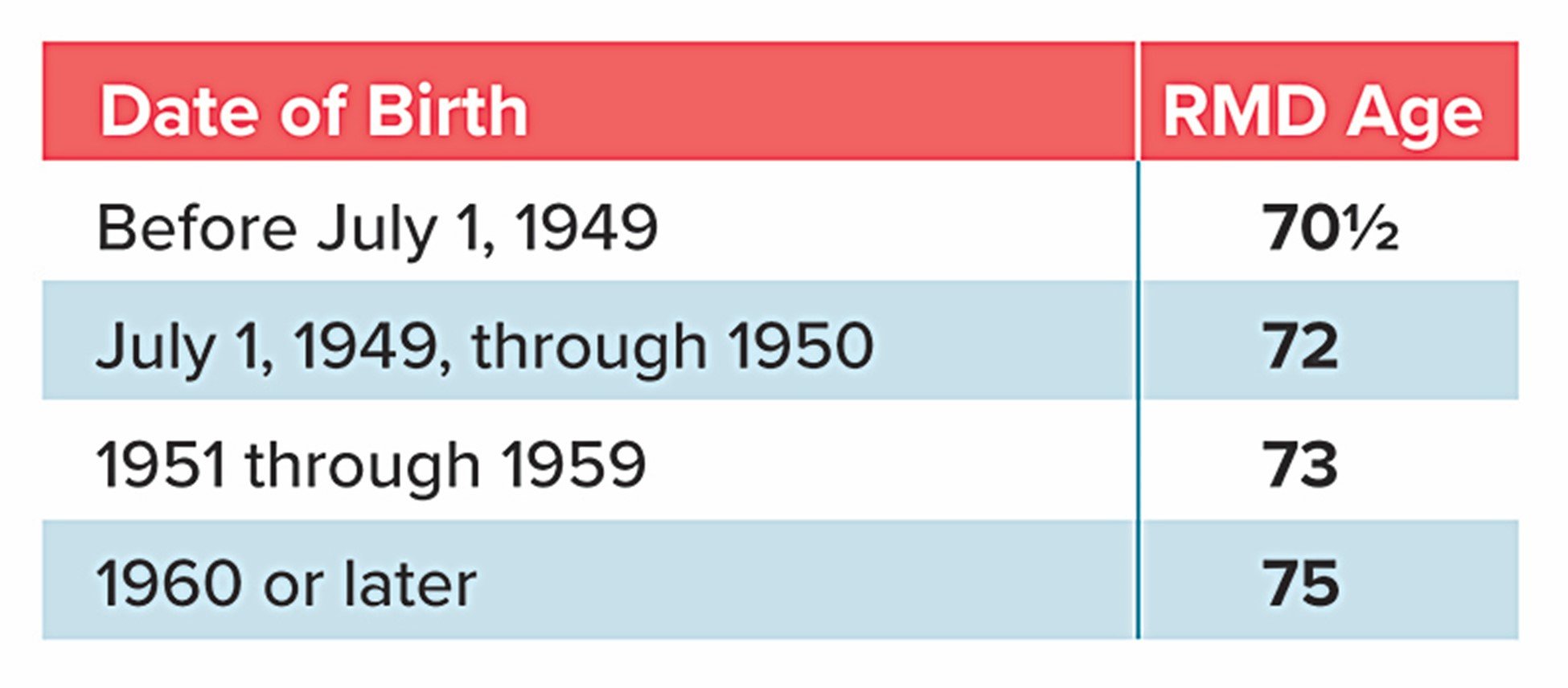

1. Perhaps the most notable change resulting from the SECURE 2.0 Act is the age at which RMDs must begin. Prior to 2020, the RMD age was 70½. After passage of the first SECURE Act in 2019, the age rose to 72 for those reaching age 70½ after December 31, 2019. Beginning in 2023, SECURE 2.0 raised the age to 73 for those reaching age 72 after December 31, 2022, and, in 2033, to 75 for those who reach age 73 after December 31, 2032.

When Must RMDs Begin?

2. A second important change is the penalty for taking less than the total RMD amount in any given year. Prior to passage of SECURE 2.0, the penalty was 50% of the difference between the amount that should have been distributed and the amount actually withdrawn. The tax is now 25% of the difference and may be reduced further to 10% if the mistake is corrected in a timely manner (as defined by the IRS).

3. A primary benefit of Roth IRAs is that account owners (and typically their spouses) are not required to take RMDs from those accounts during their lifetimes, which can enhance estate-planning strategies. A provision in SECURE 2.0 brings work-based Roth accounts in line with Roth IRAs. Beginning in 2024, employer-sponsored Roth 401(k) accounts will no longer be subject to RMDs during the original account owner's lifetime. (Beneficiaries, however, must generally take RMDs after inheriting accounts.)

4. Similarly, a provision in SECURE 2.0 ensures that surviving spouses who are sole beneficiaries of a work-based account are treated the same as their IRA counterparts beginning in 2024. Specifically, surviving spouses who are sole beneficiaries and inherit a work-based account will be able to treat the account as their own. Spouses will then be able to use the favorable uniform lifetime table, rather than the single life table, to calculate RMDs. Spouses will also be able to delay taking distributions until they reach their RMD age or until the account owner would have reached RMD age.

How to Calculate RMDs

RMDs are calculated by dividing your account balance by a life expectancy factor specified in IRS tables (see IRS Publication 590-B). Generally, you would use the account balance as of the previous December 31 to determine the current year's RMD.

For example, say you reach age 73 in 2024 and have $300,000 in a traditional IRA on December 31, 2023. Using the IRS's Uniform Lifetime Table, your RMD for 2024 would be $11,321 ($300,000 ÷ 26.5).

The IRS allows you to delay your first RMD until April 1 of the year following the year in which it is required. So in the above example, you would be able to delay the $11,321 distribution until as late as April 1, 2025. However, you will not be allowed to delay your second RMD beyond December 31 of that same year — which means you would have to take two RMDs in 2025. This could have significant implications for your income tax obligation, so beware.

An RMD is calculated separately for each IRA you have; however, you can withdraw the total from any one or more IRAs. Similar rules apply to 403(b) accounts. With other work-based plans, an RMD is calculated for and paid from each plan separately.

For more information about RMDs, contact your tax or financial professional. There is no assurance that working with a financial professional will improve investment results.