Here are some things to consider as you weigh potential tax moves before the end of the year.

Set Aside Time to Plan

Effective planning requires that you have a good understanding of your current tax situation, as well as a reasonable estimate of how your circumstances might change next year. There's a real opportunity for tax savings if you'll be paying taxes at a lower rate in one year than in the other. However, the window for most tax-saving moves closes on December 31, so don't procrastinate.

Defer Income to Next Year

Consider opportunities to defer income to 2024, particularly if you think you may be in a lower tax bracket then. For example, you may be able to defer a year-end bonus or delay the collection of business debts, rents, and payments for services in order to postpone payment of tax on the income until next year.

Accelerate Deductions

Look for opportunities to accelerate deductions into the current tax year. If you itemize deductions, making payments for deductible expenses such as qualifying interest, state taxes, and medical expenses before the end of the year (instead of paying them in early 2024) could make a difference on your 2023 return.

Make Deductible Charitable Contributions

If you itemize deductions on your federal income tax return, you can generally deduct charitable contributions, but the deduction is limited to 50% (currently increased to 60% for cash contributions to public charities), 30%, or 20% of your adjusted gross income, depending on the type of property you give and the type of organization to which you contribute. (Excess amounts can be carried over for up to five years.)

Increase Withholding

If it looks as though you're going to owe federal income tax for the year, consider increasing your withholding on Form W-4 for the remainder of the year to cover the shortfall. The biggest advantage in doing so is that withholding is considered as having been paid evenly throughout the year instead of when the dollars are actually taken from your paycheck.

More to Consider

Here are some other things to consider as part of your year-end tax review.

Save More for Retirement

Deductible contributions to a traditional IRA and pre-tax contributions to an employer-sponsored retirement plan such as a 401(k) can help reduce your 2023 taxable income. If you haven't already contributed up to the maximum amount allowed, consider doing so. For 2023, you can contribute up to $22,500 to a 401(k) plan ($30,000 if you're age 50 or older) and up to $6,500 to traditional and Roth IRAs combined ($7,500 if you're age 50 or older). The window to make 2023 contributions to an employer plan generally closes at the end of the year, while you have until April 15, 2024, to make 2023 IRA contributions. (Roth contributions are not deductible, but qualified Roth distributions are not taxable.)

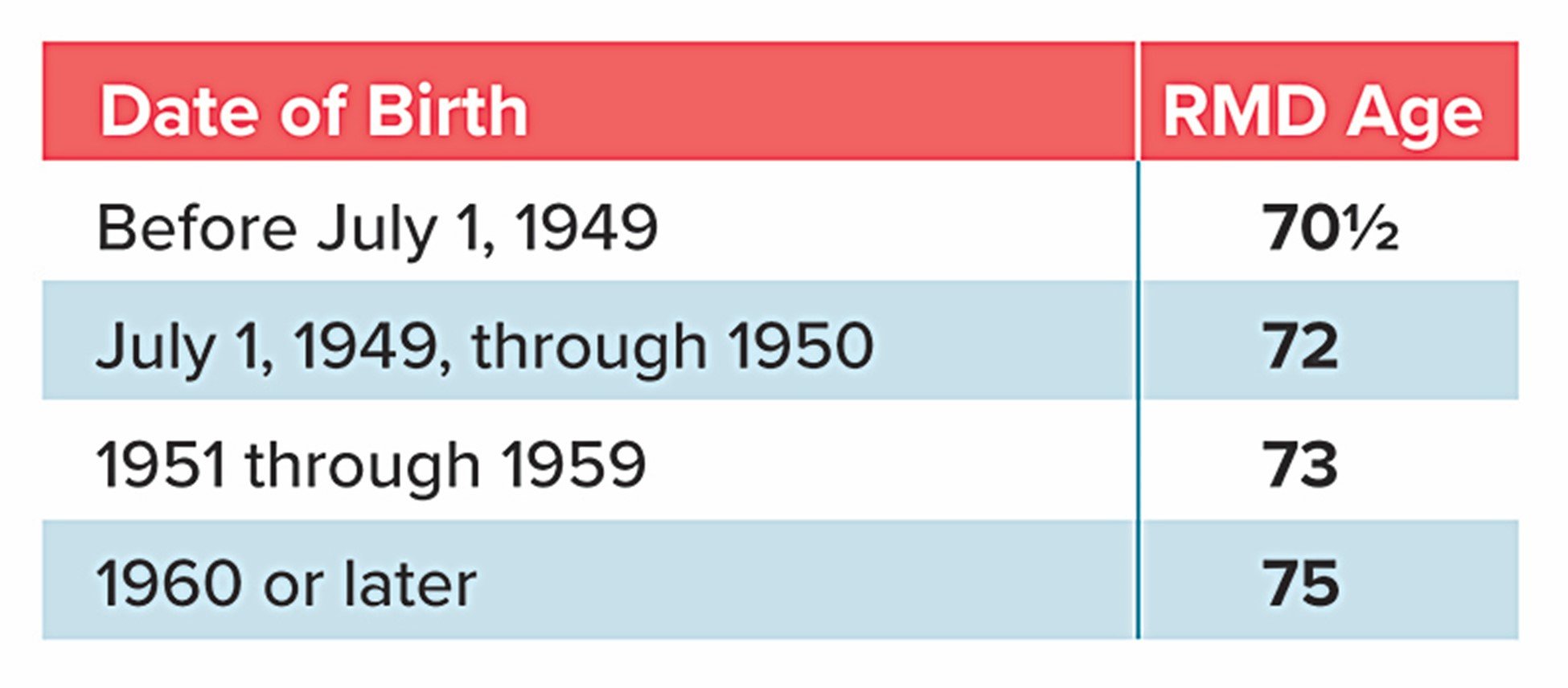

Take Any Required Distributions

If you are age 73 or older, you generally must take required minimum distributions (RMDs) from your traditional IRAs and employer-sponsored retirement plans (an exception may apply if you're still working for the employer sponsoring the plan). Take any distributions by the date required — the end of the year for most individuals. The penalty for failing to do so is substantial: 25% of any amount that you failed to distribute as required (10% if corrected in a timely manner). Beneficiaries are generally required to take annual distributions from inherited retirement accounts (and under certain circumstances, a distribution of the entire account 10 years after certain events, such as the death of the IRA owner or the beneficiary); there are special rules for spouses.

Weigh Year-End Investment Moves

Though you shouldn't let tax considerations drive your investment decisions, it's worth considering the tax implications of any year-end investment moves. For example, if you have realized net capital gains from selling securities at a profit, you might avoid being taxed on some or all of those gains by selling losing positions. Any losses above the amount of your gains can be used to offset up to $3,000 of ordinary income ($1,500 if your filing status is married filing separately) or carried forward to reduce your taxes in future years.