As young adults embark on their first real job, get married, or start a family, retirement might be the last thing on their minds. Even so, they might want to make it a financial priority. In preparing for retirement, the best time to start investing is now — for two key reasons: compounding and tax management.

Power of Compound Returns

A quick Internet search reveals that Albert Einstein once called compounding "the most powerful force in the universe," "the eighth wonder of the world," or "the greatest invention in human history." Although the validity of these quotes is debatable, Einstein would not have been far off in his assessments.

Compounding happens when returns earned on investments are reinvested in the account and earn returns themselves. Over time, the process can gain significant momentum.

For example, say an investor put $1,000 in an investment that earns 5%, or $50, in year one, which gets reinvested, bringing the total to $1,050. In year two, that money earns another 5%, or $52.50, resulting in a total of $1,102.50. Year three brings another 5%, or $55.13, totaling $1,157.63. Each year, the earnings grow a little bit more.

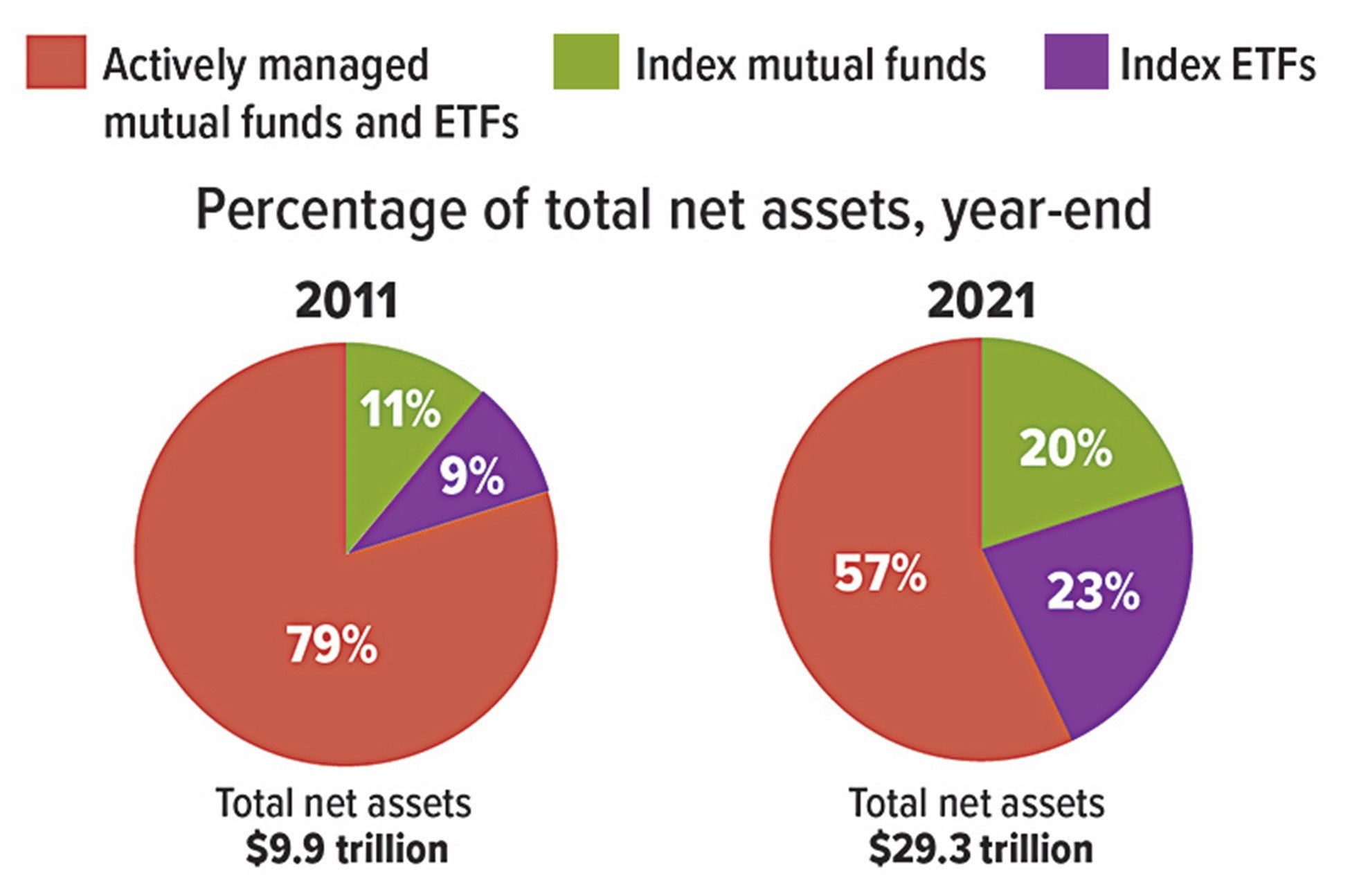

Over the long term, the results can snowball. Consider the examples in the accompanying chart.

A Head Start Can Be a Strong Ally

This chart illustrates how much an investor could accumulate by age 65 by investing $3,000 a year starting at age 25, 35, and 45 and earning a 6% annual rate of return, compounded annually.

These hypothetical examples of mathematical compounding are used for illustrative purposes only and do not reflect the performance of any specific investments. Fees, expenses, and taxes are not considered and would reduce the performance shown if they were included. Rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of investment risk. Actual results will vary.

Tax Management

Another reason to start investing for retirement now is to benefit from tax-advantaged workplace retirement plans and IRAs.

Lower taxes now. Contributions to traditional 401(k)s and similar plans are deducted from a paycheck before taxes, so contributing can result in a lower current tax bill. And depending on a taxpayer's income, filing status, and coverage by a workplace plan, contributions to a traditional IRA may result in an income tax deduction.

Tax-deferred compounding. IRAs and workplace plans like 401(k)s compound on a tax-deferred basis, which means investors don't have to pay taxes on contributions and earnings until they withdraw the money. This helps drive compounding potential through the years.

Future tax-free income. Roth contributions to both workplace accounts and IRAs offer no immediate tax benefit, but earnings grow on a tax-deferred basis, and qualified distributions are tax-free. A qualified distribution is one made after the Roth account has been held for five years and the account holder reaches age 59½, dies, or becomes disabled.

Saver's Credit. In 2022, single taxpayers with adjusted gross incomes of up to $34,000 ($66,000 if married filing jointly) may qualify for an income tax credit of up to $1,000 ($2,000 for married couples) for eligible retirement account contributions. Unlike a deduction — which helps reduce the amount of income subject to taxes — a credit is applied directly to the amount of taxes owed.

Avoiding penalties. Keep in mind that withdrawals from pre-tax retirement accounts prior to age 59½ and nonqualified withdrawals from Roth accounts are subject to a 10% penalty on top of regular income tax.

Additional Fuel for the Fire

Workplace plans that offer employer matching or profit-sharing contributions can further fuel the tax-advantaged compounding potential. Investors would be wise to consider taking full advantage of employer matching contributions, if offered.

Don't Delay

With the power of compounding and the many tax advantages, it may make sense to make retirement investing a high priority at any age.